Dec 18, 2025

PATI: A New Model for Token Issuance

The Publicly Accessible Token Issuance (PATI) is our attempt to answer a simple but increasingly important question: Given that protocol tokens are now being accepted by Wall Street, what is the optimal way to do a token generation event (TGE)?

The PATI is our proposed answer, a structure and methodology designed to maintain price and liquidity parity between US capital markets and crypto markets through a 1:1 mapping in perpetuity. The PATI is not a DAT or tokenized equity, it is fundamentally different as it tracks the entire lifecycle of a protocol token before, during, and after TGE.

The PATI is composed of three distinct stages: Public Acquisition, Token Issuance, and Fusion. Each step should be non-controversially possible to achieve independently. Taken together, they form a coherent path for bringing protocol tokens into public markets and bolstering price discovery and liquidity between TradFi and crypto.

We’ve pressure-tested the PATI concept with two top law firms, and to date have not hit any core blockers. That said, this work is exploratory and remains a work in progress, and we are intentionally presenting it for discussion and critique by the broader legal, regulatory, and technical communities. We do not know yet if we will pursue this design, but believe the ideas are directionally important and worth putting forward.

Importantly, market structure regulation is paramount. Proposed frameworks such as FIT21 and/or the CLARITY Acts present meaningful attempts to define clear rules for crypto market structure. While the current administration and the SEC appear more supportive of crypto, that is not guaranteed to persist. Durable, explicit regulation is essential if mechanisms like the PATI are to be attempted responsibly and, ultimately, adopted at scale.

We expect ETPs, DATs, and the PATI, to be the first, and certainly not the last, ways that Wall Street experiments with products built around protocol tokens. Clear market structure regulation is therefore paramount to providing a viable path forward for these instruments and the next generation of on-chain capital formation in the US and beyond.

Special thanks to Pat Berarducci, Rodrigo Seira, Eric Blanchard, Steve Wink, Zachary Fallon, Aaron Gilbride, Yvette Valdez, Bryan Bullet, and Prat Vallabhaneni in their help in formulating these ideas.

The Publicly Accessible Token Issuance (PATI)

In the past decade, blockchain protocols have explored various methods of financing and distribution of their corresponding protocol tokens that do not incorporate a clear market structure framework. The proposed CLARITY Act provides clear guidelines for when a token can be launched and categorically deemed a commodity through decentralization prongs, with corresponding safe harbors and period to transition from an investment contract to a commodity. We now have the opportunity to update the method for issuing and selling new protocol tokens while incorporating the deep financial infrastructure and liquidity that the US capital markets carry.

In this paper, we introduce the Publicly Accessible Token Issuance (PATI), a revolutionary new vehicle that aims to connect public markets with cryptocurrency issuances seamlessly. The PATI involves three steps: Public Acquisition, Token Issuance, and Fusion. By doing all three, it resolves the liquidity gap permanently between public markets and crypto markets while allowing a 1:1 mapping to be clearly maintained between the two respective markets, always accessing the deep liquidity of both. By integrating pre- and post-launch liquidity across both traditional and cryptocurrency financial systems, the PATI unlocks a broader investor base for crypto protocols thereby increasing the target protocol’s opportunity for long term success.

Public Acquisition: A publicly listed company is used to issue the token. This can be done with an existing public company, or the use of a public company that acquires the crypto protocol, a transaction that can use a SPAC, reverse merger, and/or PIPE.

Token Issuance: Using the CLARITY act prongs as a guideline, the public company shares are used to issue the non-security token in a 1:1 mapping according to shareholders of record. This can be done either by the use of a property dividend or a foundation airdrop, explained below.

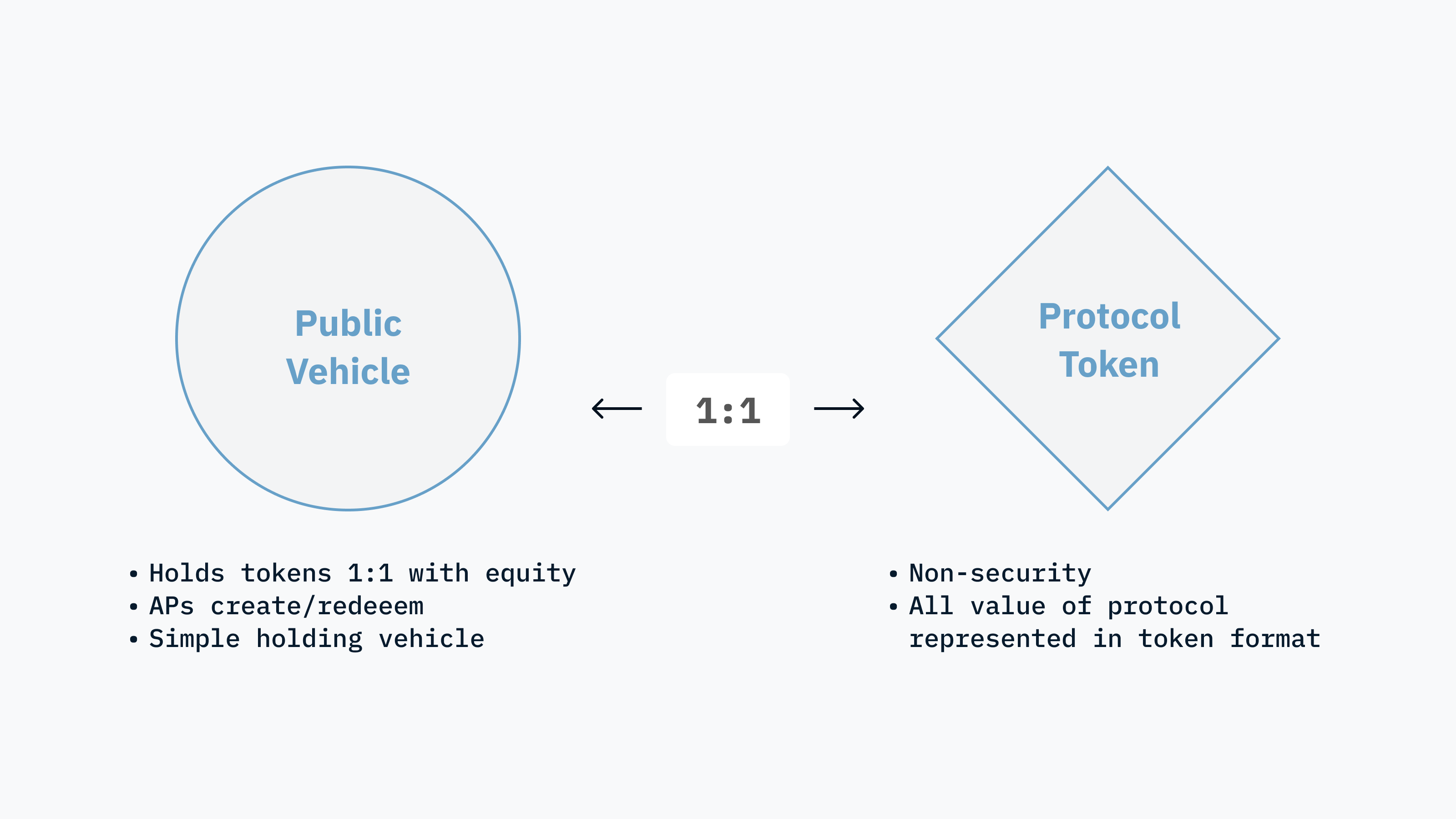

Fusion: The public company is converted to a publicly traded SPV that has no further economics associated with it other than to facilitate 1:1 conversions between equity and tokens. Previous iterations of these structures have successfully used an ETP with APs that allow the conversion to take place, in which the publicly traded vehicle is a security and the underlying asset is a commodity (see iShares IAU, IBIT).

We have now completed the full lifecycle of a token and appropriately connected public markets with crypto markets for a respective protocol token in perpetuity. By using public markets we allow for trading of the protocol before the token is released, while following relevant disclosures and integrating with existing regulatory infrastructure. If implemented, we believe the PATI will pave the way to replace Token Generation Events (TGE) going forward, as accessing public market liquidity and maintaining the 1:1 mapping strictly widens the universe of potential buyers and is a net positive based on the status quo. We wish to present the PATI for feedback and discussion with the hopes of iterating and achieving the final result and method that market participants use going forward.

Limitations of Prior Token Issuance Models

Up until now there have been years of experimentation in which developers have created blockchain protocols with tokens, and have used various methods to launch and/or finance them. Almost all of these have been sold in private sales and those that have been done in public sales have had limited distribution to crypto users only. Additionally, pre-CLARITY, there has not been a clear regulatory framework to incorporate TGEs, and therefore the use of public markets has not been possible. The PATI is designed and presented in response to all of these issues, and pushes us towards the most optimal outcome possible for protocol tokens to flourish fully.

Protocol Tokens

A blockchain is a public decentralized ledger and network which stores transactions on behalf of any entity that wishes to sign transactions on the network. Bitcoin introduced this concept using Proof of Work, under which rewards were provided to miners for validating a mathematical problem, and BTC was generated on a provable inflation schedule in exchange for miners completing this challenge. Ethereum uses smart contracts and more complex transactions and started with a POW mechanism and later transitioned to Proof of Stake, under which entities post their protocol tokens in order to validate the blocks. The security of both networks relies on a decentralized currency, i.e. a crypto currency, which is issued and used as the currency to pay and reward miners for validating the network. Public blockchains all inherently require protocol tokens in order to function, and generally protocols wish for their tokens to be distributed to as many holders as possible to ensure decentralized control over the network.

History of Fundraising

When developers have a new idea for a blockchain that they wish to launch, it likely requires many millions of dollars in both developer salaries and infrastructure, and therefore the developers engage with investors to help them realize their vision. Many iterations of funding new protocols and distributing new cryptocurrencies have been tried, including but not limited to ICOs/Token Sales, privates sales through SAFT/Token Warrant, or yield farming/airdrops:

ICOs/Token Sales: Developers sell the tokens through a public blockchain directly. They allocate a certain amount of their outstanding protocol tokens for the sale, and receive crypto currency directly in exchange. This method was popular in 2017, but posed regulatory issues. In recent years it has regained popularity, however these sales require buyers to be knowledgeable of crypto infrastructure and be able to engage with wallets and/or smart contracts directly, vastly limiting the number of both retail and institutional buyers that can participate.

SAFTS/Token Warrants: Developers sell legal instruments which later convert into protocol tokens directly. This is probably the most common method of financing for private investors of protocol tokens, under which accredited investors, VC funds, and select angels invest in projects and receive tokens at a later date. While we believe this method will always be used, especially in very early stage projects, it is not optimal to continue in later rounds and through the TGE as it significantly limits the distribution of a token to a small number of buyers.

Yield Farming/Airdrop: Developers provide tokens in exchange for targeted metrics. In this method, developers allocate a certain percentage of their tokens to users that are rewarded for completing activity on the network, and is usually used to bootstrap behavior, such as Volume or Total Value Locked (TVL) ie AUM, which are popular metrics that are used to measure a crypto protocol’s success. This method was widely used to distribute tokens in 2020-2021 and has had success amongst a select few number of projects since. In addition to requiring users to understand the crypto infrastructure, it calls for the user to use the protocol and then often results in the user selling the token immediately, sometimes creating the worst of both worlds in which there is low distribution of holders and a high occurrence of sellers of the tokens. It should be noted however that Hyperliquid is a recent token launch that had success with the airdrop method, as it has incentivized a high number of users vs the supply of sellers given they did not take investor capital.

While these mechanisms have served the crypto industry participants with some success, they also have significant limitations. Primarily, accessing these offerings require knowledge and access to wallet infrastructure and/or cryptocurrency exchanges. This friction causes large user drop off, even if users are willing to go through these hoops in order to access returns; those users are only a fraction of what is available through traditional finance markets.

Aside from the technical complexity, many institutional purchasers simply do not have the legal or brokerage mechanics to access the crypto markets. This introduces significant barriers to adoption and access for users to purchase the protocol tokens, and limits liquidity significantly.

Incorporating U.S. Capital Markets

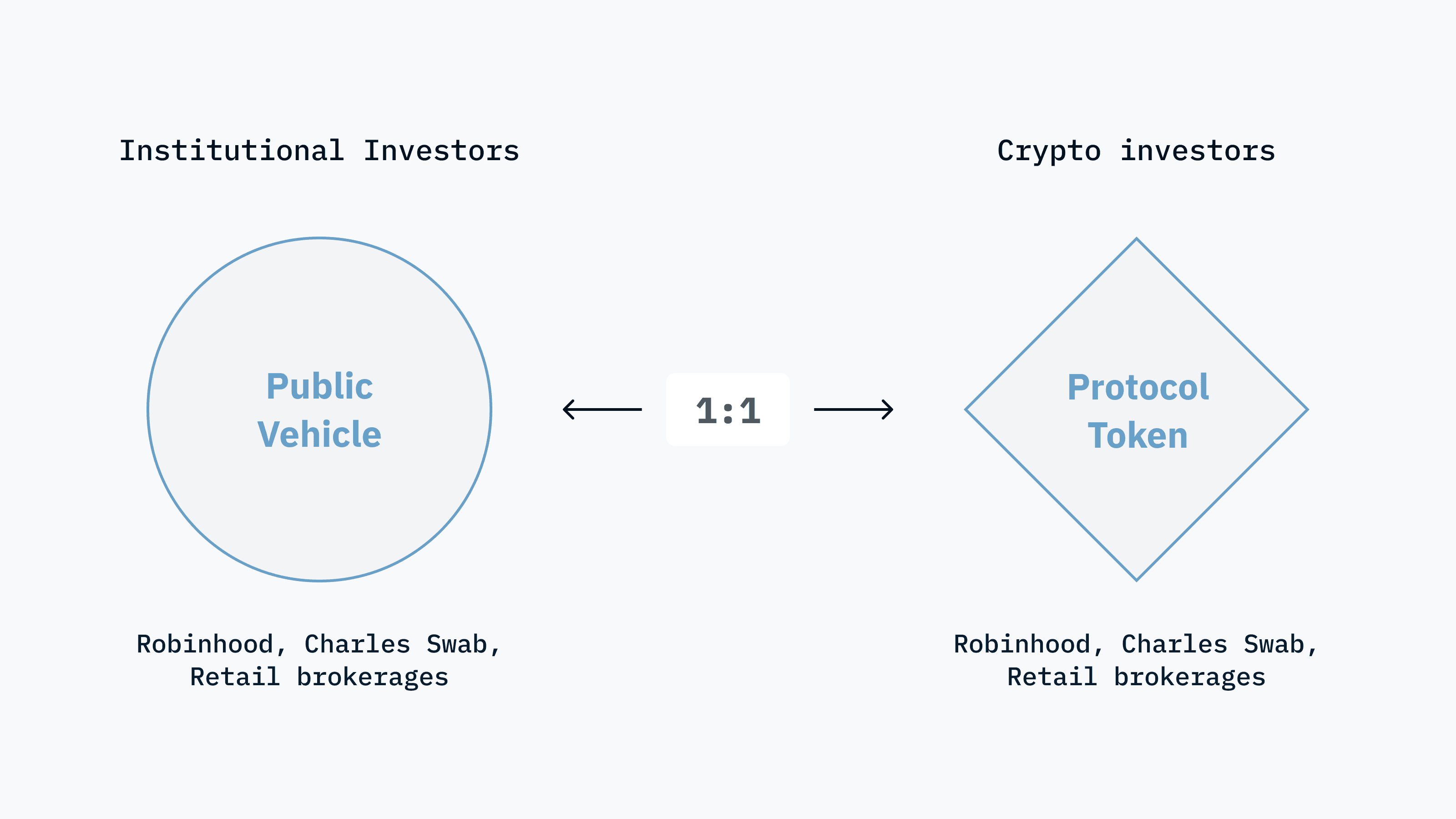

In contrast, US public markets are deep and liquid, with both institutional and retail participants. The amount of capital that flows through them vastly eclipses that of the crypto markets, and the financial plumbing included is both sophisticated and battle tested. After or even during an IPO, users can trade the given security on secondary markets, through their brokerage accounts. Retail participants generally trade through brokerages including but not limited to Robinhood, ETrade, and Charles Schwab. These retail participants amount to significant volumes alongside institutional.

Hedge funds are paramount in establishing liquidity in the markets, and account for ~30% of global daily turnover in equities. In the Circle IPO, institutional investors accounted for nearly 100% of the purchases, amounting to a raise of over $1bn. The recent explosion of public market vehicles, known as Digital Asset Treasuries or DATs, purchase and hold crypto (MSTR, SBET) are evidence that adequate demand existed in public markets for crypto-linked assets.

The PATI model uniquely provides dual-access liquidity, opening protocol ownership to both retail and institutional buyers. Anyone with a securities account would be able to purchase the securities. Additionally, since the equity is eventually redeemable 1:1 for the protocol token, the wide and global universe of crypto users will be able to access it as well. By creating a vehicle in the public markets, and then allowing it to be linked to the crypto markets, we have widened the universe of buyers for a given protocol dramatically.

Passing the CLARITY Act is Paramount

Tantamount to any of this being possible is the CLARITY Act, or similarly contemplated legislation, that defines when a token can move from an investment contract to a commodity. The goal of the Act is to clarify concepts that have been discussed for many years in the cryptocurrency industry, notably that when an investment contract is sold, it does not necessarily mean that the underlying asset is a security. This was most notable in the actual Howey case which ultimately became the Howey Test, under which oranges were sold in a scheme that ultimately were deemed to be an investment contract, however the underlying assets (oranges) were never securities. This distinction is the most notable and applies to crypto protocol tokens, in which case even if they are sold in a way that might be deemed an investment contract, the underlying protocol token which provides utility on the blockchain network should not automatically be deemed a security. The CLARITY Act successfully acknowledged this nuance and provided guidelines for when a cryptocurrency would transition from being an investment contract to a commodity.

Specifically, it defined decentralization prongs and allows for a 3 year safe harbor to achieve the desired levels of decentralization. To achieve decentralization, the network must be launched, not be centrally controlled by the developers, have wide dispersion of the token in which case the token is used intrinsically in the network, and the developers must file various disclosures. The three year safe harbor allows developers the time required to achieve these prongs. The purpose of this paper is not to get into the weeds of the regulation, it is to acknowledge the potential for a clear regulatory framework for tokens to be deemed commodities. We welcome the reader to study the Act in detail to understand what could be required, especially if they are developers that wish to use a PATI to launch their protocol token.

Importantly, proposed market structure legislation should define a mechanism for American developers or foreign issuers that wish to sell to Americans a way to offer their tokens in compliance It removes regulatory uncertainty and upgrades market structure to allow Wall Street to engage in underwriting and issuing tokens, as well as investors to purchase these assets without the risk of the SEC deeming that they run afoul of the law. This is in sharp contrast to the previous iteration of crypto under which regulatory uncertainty allowed politically motivated regulators to hamper development and growth and ultimately American participation in cryptocurrency markets. Offering tokens compliantly still needs clear guidelines, as they touch grey areas that could result in a legal fight with regulators that even if the developer was in the right, would provide costly in terms of time and cost.

We expect the CLARITY, or similar legislation, to provide many new methods of fundraising and launching tokens, of which the PATI will be one, however feel that the PATI is a significant augmentation and a novel implementation as it connects public markets with crypto markets seamlessly for the entire lifecycle of the project. We should assume going forward that a project that wishes to do a PATI can use the CLARITY guidelines to issue their tokens, while we are cognizant that the regulation has not yet passed.

PATI Mechanics: Step-by-Step

We outline the mechanism for the PATI to begin as a public company with the future intention to issue the token, followed by the issuance of the token, and then a conversion where the public company becomes an ETP and maintains a 1:1 relationship between the public markets and crypto markets.

Importantly, we wish to note that each of these steps should be independently and non-controversially possible. We are simply combining the three in order to achieve the full lifecycle of the token’s existence and achieving optimal liquidity and access to both traditional capital markets and crypto capital markets while maintaining compliance.

Step 1: Public Acquisition

Prior to the token generation event (TGE), where a crypto protocol does the primary issuance of the protocol token to it’s set of desired holders, we wish to target a public company that can house the crypto protocol IP and can later provide the shareholders of record to issue the token 1:1 in accordance with the equity. If successful, we create a public markets vehicle, accessible in anyone’s brokerage account, with corresponding investors that have the right to the full economics of the protocol token going forward, and this vehicle is tradeable pre-TGE by both retail and institutional investors alike. This achieves deep liquidity as well as wider distribution than for example if the protocol decides to do another private round with a handful of investors.

To achieve the goal of a publicly accessible pre-TGE vehicle, the protocol should engage with a public company to acquire it, or should facilitate it’s own IPO; either way, there should be publicly traded shares and relevant disclosures completed with a given pubco.

SPAC, Reverse Merger, and/or PIPE

We feel the fastest way to go to market with such a vehicle would be through a public company that has either been created for these purposes, or has gone through a bankruptcy process which strips it of all liabilities. There are three well-known ways of doing this: either with a SPAC, a reverse merger, or a PIPE into an existing vehicle. All three come with their own advantages and disadvantages, which are well understood and analyzed by various law firms. The exact path that a protocol chooses should be aligned with the goals and resources of the protocol itself, and therefore the discussion of which path to take is beyond the scope of this paper. Importantly, protocols should have a path to become publicly tradeable through one of these methods.

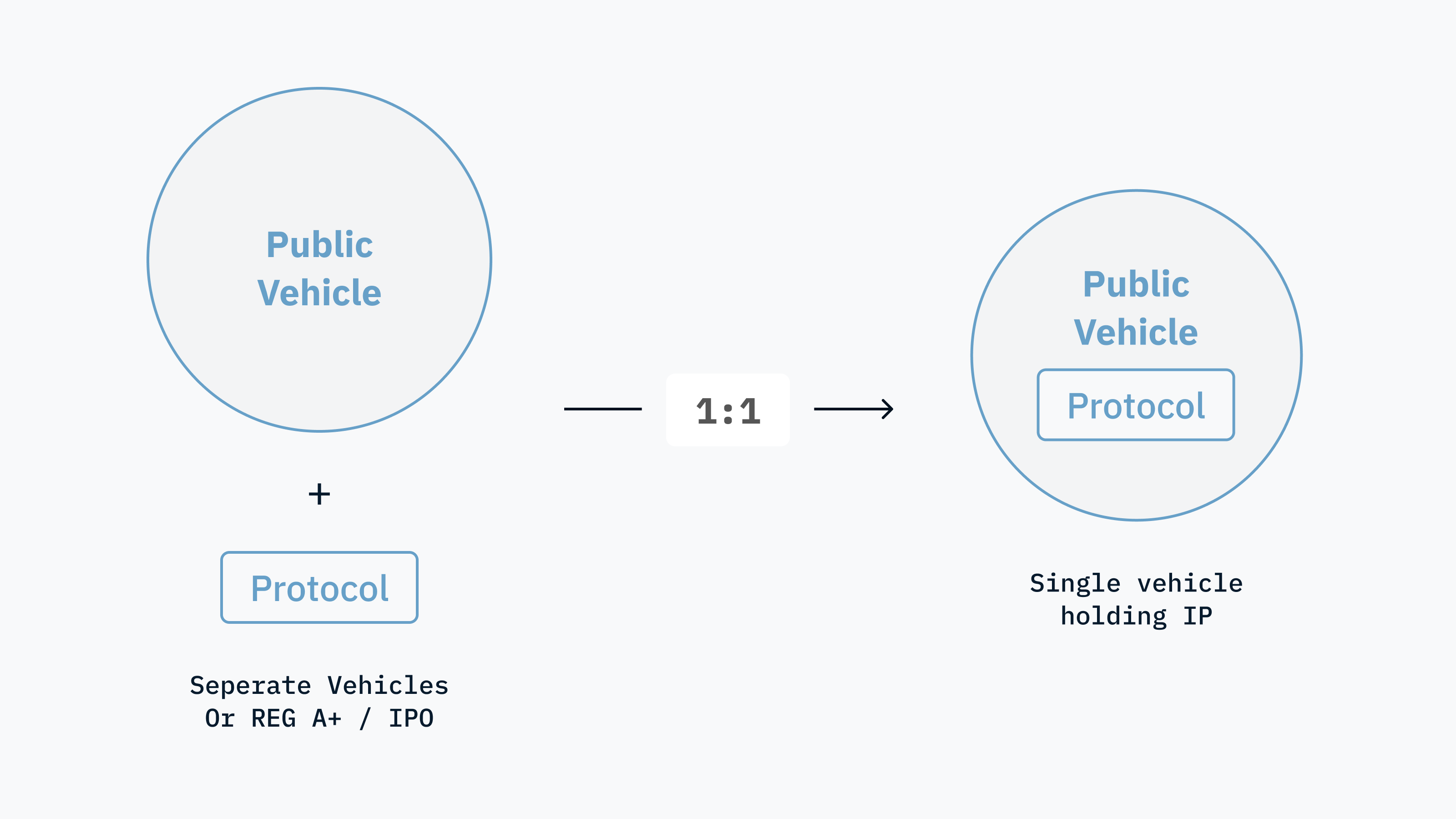

IPO, Reg A+, and/or Use Existing Pubco

Additionally, protocols that are living in a private company can transition to a public company through more classical methods like doing a full IPO process, or using Reg A+ if the given restrictions on fundraising are acceptable to the protocol. Public companies that already exist as a centralized business and wish to convert their business line into a decentralized protocol with a corresponding protocol token can become a PATI as well. The overarching theme is that we are using a public company, with it’s included infrastructure, to issue the token.

Pubco Ready for TGE

By using a public company, we are providing immediate access to institutional investors which already have the financial infrastructure to invest and trade in US equity markets. These investors commonly engage with public companies through PIPE offerings. And importantly, a listed public company also provides immediate access via retail brokerage platforms, such as Robinhood, enabling broad public participation and liquidity from day one.

In order to transition from a private company developing a protocol to a public company, the developers will have to file various detailed disclosures including but not limited to audited financial statements, cap tables, and business plans, which will give buyers the adequate information necessary to make informed investment decisions. These disclosures are a significant upgrade from current market standards and we believe regulators will be in favor of this approach.

Once the public acquisition is completed, and the shares are tradeable in US equity markets, the company should be ready to issue the token.

Step 2: Token Issuance

The CLARITY act, or similar legislation once passed, provides clear guidelines for when a token can be sold or issued as an investment contract which has a 3 year safe harbor to be able to be converted into a commodity. We rely on these guidelines, and have the public company issue a non-security token. We propose that the issuance of the token should either be done as a property dividend or as an airdrop. In either case, the shareholders of record are entitled to the protocol token in a 1:1 ratio with the shares, and all economics of the shares should move completely to the protocol token post issuance.

The public company passes a board resolution and subsequently announces their intention to issue the token, through either of the methods described below.

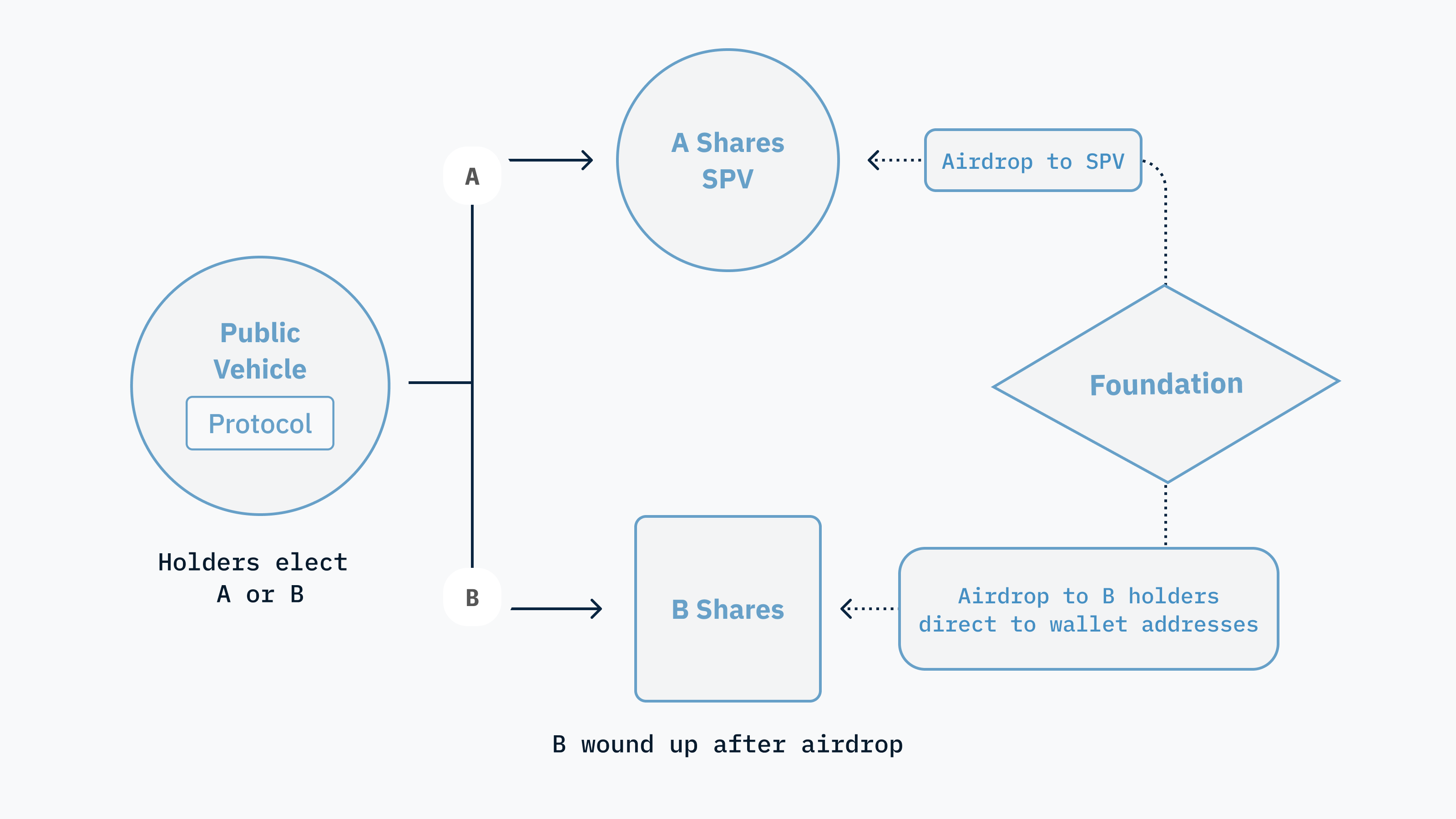

Property Dividend

If the company wishes to issue a property dividend, it does so by splitting it’s stock into two share classes, in which case the investor elects to receive one of the two:

Class A Shares which the holders maintain as equity shares.

Class B Shares entitle the holder to receive the property token.

Shareholders effectively elect whether to receive traditional equity or the property token. The B shareholders would receive the property token on the payable date. On that date, the public company dividends the protocol token in a 1:1 ratio with the underlying publicly traded equity to B share holders, and then all other B shares would be rolled up and no longer exist. Precedent for this mechanism exists since BTCS did a property dividend for BTC, under which BTC was deemed as a commodity.

The mechanisms for doing the split into A shares and B shares involve an election portal which should be offered by the individual brokerage houses, similar to any corporate action. We then will need to collect wallet addresses for the B shareholders which are set to receive the tokens. Once the payable date is complete, the B shares are converted into B’ tokens, which are sent to the wallet addresses of B shareholders and then the company winds up the B class of shares.

Therefore, pre split of shares if we have X tokens total, post split we would have A + B = X, and then post payable date we would have A + B’ = X, in which B’ represents the tokens that the holders receive after completion of the token payout, and the B shares are removed from circulation. This way always 100% of the tokens are represented either in shares or token format at all times, and holders can seamlessly elect between the two.

Foundation Airdrop

Alternatively, and likely more simplistically, the foundation used to govern the open source protocol can create the protocol tokens, and then airdrop the tokens to corresponding shareholders. This would treat the company more as an SPV that holds tokens directly, and does not break out the individual holders of the tokens. One airdrop is done to the public company, and we then know that the public company holds the private keys to the underlying assets and therefore the corresponding economics. This method is likely easier operationally but does not achieve the desired distribution of tokens to end users because the public company holds all of the tokens without a clear mechanism for users to redeem them into protocol tokens. The operational overhead tradeoff however may be worth it, as the ultimate state of the public company shares with a 1:1 conversion to token can achieve the desired result of accessing both markets adequately.

After the tokens are created and distributed, either as a property dividend or a foundation airdrop, and importantly under CLARITY under which they are deemed non-securities or have the relevant safe harbor to allow developers to achieve decentralization, we pursue the last step in the process which is converting the public company to an ETP that allows for 1:1 conversions between the equity and the protocol token.

Step 3: Fusion

Key to the PATI to work is the conversion of the existing public market shares into an ETP, similar to the Blackrock iShares ETP that holds underlying commodities for example BTC or ETH and allows for create/redeems through an AP.

In parallel to issuing the token, the public company should modify the bylaws and file an S1 that states its intentions to convert to an ETP. The ETP would be a single purpose vehicle that has no ambiguity about what the ETP holds, and no residual economic interest or business line should remain tied to the shares of the company, beyond its representation and holding of the underlying tokens. The ETP would hold tokens in a 1:1 ratio with the shares, similar to gold or oil ETPs, under which the shares are traded in equity markets while the underlying commodity trades on another venue.

To ensure that the economics of the ETP are aligned with the protocol foundation, the vehicle’s sponsor should either be the protocol foundation or a joint venture between the protocol foundation and a reputable Wall Street firm that has the back office systems and compliance to interact with both legacy and crypto finance markets. Blackrock’s iShares, having interacted with both Bitcoin and Ether ETFs, would be a good candidate to partner with a given protocol. It is important however that the protocol is aligned with the vehicle and benefits in the reward of a high AUM alongside the traditional finance firm.

A paramount component to the ETP is the create/redeem process. Authorized Participants (APs) act as the bridge to the ETP, exchanging tokens (or cash in-kind) for shares, and vice versa. The ETP would then track the Net Asset Value (NAV) of the holdings in the fund, and APs can create/redeem against this NAV value on a daily basis. This way, it is ensured that shares are trading in parallel with the token markets, as APs arbitrage any discrepancies to keep their positions flat, hedged or close to 0. This mechanism also allows for both markets to rise and fall in tandem; thus achieving a perfect balance between both the traditional finance and crypto ecosystems, with access to all forms of global liquidity.

However, there are certain challenges with converting to an ETP in which case the underlying commodity is new and/or in the process of converting. Specifically, the SEC will only consider ETPs under which the underlying market is surveillable. In the case of crypto, the underlying market has not been deemed surveillable and therefore the SEC has relied on regulated futures (ie CME) to meet this requirement. To qualify, we will either rely on a regulated spot or futures market in which the underlying protocol tokens trade, and could pursue a relationship with existing FCMs.

We wish to note that it is possible that since the equity market prior to token issuance would be the primary tradeable market, that the SEC may deem the pre-Token Issuance market as having been surveiled. This is a little bit of an uncertainty and the reader should not rely on this assumption, but it is worth exploring and engaging with the SEC on this topic.

In the case that the SEC is not yet comfortable with approving an ETP on the underlying token commodity, the vehicle can operate as a closed-end fund. In this model, the fund publishes daily holdings and NAV, and does at the money (ATM) offerings, thereby maintaining the public market price with the token value. While not ideal, this solution serves as a medium-term bridge until the SEC is comfortable with the underlying spot or futures markets and a conversion to an ETP is approved.

Implications

By creating a vehicle that is represented both in traditional finance and crypto finance with a 1:1 structure, PATI bridges the two ecosystems, unlocking public market liquidity before and during issuance, with clear disclosures that are much better for investors. Post-ETP conversion, the equity can be traded in Robinhood while the token can be traded on Binance, and we have increased the universe of buyers able to access and drive value to the protocol.

Protocols that aim to retain equity and drive value to their cap table, rather than driving all value to their token holders, do not align with this model. Structures in which shareholders are rewarded but token holders are not, should be moved away from as an industry, as they create misaligned incentives and undermine the premise that a token is meant to represent participation in a protocol's growth. PATI offers the clearest path not only to access capital markets liquidity, but to drive all future value to token holders.

Using the PATI as a new mechanism gives significant liquidity and buyer access to the underlying protocol token, better terms and disclosures to investors, deeper market access, and therefore increases the probability of success of the project. We foresee that this method will be adopted by crypto protocols and should widely replace the Token Generation Event (TGE) going forward.

References for the PATI

While the PATI may resemble several historical token models, it is in fact a new mechanism that differs significantly from existing designs. We expect the PATI and many more iterations of token issuances to be tried now that Wall Street is deeply studying crypto. Let’s review some of the previous designs and why the PATI is net-better than each.

Unlike ICO

Starting in 2017, many projects opted for Initial Coin Offerings (ICOs), or token sales, sold tokens directly to the public using blockchain infrastructure. ICOs faced practical limitations. They offered limited market access and liquidity, requiring users to connect to a crypto wallet, use ETH (or another crypto asset) as a base currency, and/or sign up for an exchange like Binance to participate. These barriers to entry significantly reduced the number of users who could purchase tokens, limiting overall demand. After some time, the supply of tokens increased, the demand waned, and this model fell out of favor.

Additionally, the SEC often viewed these offerings as noncompliant. Even if a project was in fact selling a good or access to the protocol token with the correct disclosures, these projects were often pulled into the broad umbrella of the Howey Test. We expect CLARITY or similar legislation to remove these uncertainties entirely, and provide a clear path to compliance, so direct ICO’s using blockchain infrastructure will be tried again. Again, these offerings will be limited in distribution.

The PATI dramatically expands the supply of eligible buyers and capital, creating a demand advantage for protocols that are able to launch their tokens in the US public equity markets. The US public markets are the most sophisticated and liquid in the world, and we should strive to access before/during a given protocol’s TGE.

Unlike Yield Farming or an Airdrop

A common method that protocols use to distribute their tokens is through yield farming or airdrops. They do this by allocating tokens to users without requiring a direct payment or exchange of monetary value. Instead they reward users for using and therefore bootstrapping network activity, increasing metrics such as volume or TVL, while the protocol is still finding product-market fit and organic usage. Users that engage with the protocol are rewarded by receiving tokens directly to their wallet, and this is often the method in which protocols will launch their tokens.

We believe that the airdrop introduces challenges since users can directly sell the token and do not have an incentive to hold long term. Therefore, if the protocol does not have underlying economics which cause the token to be purchased or provide rewards in other ways, users will always sell immediately. However, a good protocol with adequate usage should consider the use of an airdrop as it is a powerful mechanism, and we therefore believe it will always have a core place in crypto markets.

We don’t expect the PATI to replace the airdrop, however it sits in a category of itself under which it is not being used to incentivize behavior on the network. Rather, it is used as a fundraising and token distribution mechanism.

Unlike SPAC

SPACs became a popular method to take companies public without going through the traditional IPO process, which is much more rigorous. The financial engineering allowed for companies to raise money into a shell company and only later acquiring the private company, thereby “backdooring” into an IPO.

This created an adverse selection problem: companies that were not developed enough to undergo a regular IPO process often turned to SPACs. The best companies still IPO’d (Snowflake, Circle), leaving SPAC as a vehicle for second tier companies, and those companies generally have performed poorly. Nevertheless, the use of a SPAC should be studied as a potential acquisition vehicle for the PATI, as it provides a faster method to go to market with a public vehicle. The use of a SPAC vs a regular IPO simply has to do with resources, a regular IPO can be done as well if the business model supports it.

In contrast to a SPAC, the PATI does not involve acquiring a company’s underlying business to trade it in a public market. Instead, the PATI is a vehicle to use the public markets to issue a native blockchain token, a result which is at least as strong as current token issuance models. It is net positive for the crypto industry and represents a bridge to a new financial instrument, rather than a vehicle for trading sub-par listings.

Unlike Tokenized Equities

Popular as-of late have been tokenized equities or the ability to represent private or public units of a security in tokenized format. Robinhood has experimented with the listing of SpaceX and OpenAI shares, as well as Tesla and other popular retail stocks. These provide value in which the user cannot normally access the returns of the underlying equities due to geographic limitations or access to private capital markets, amongst other reasons. Additionally many firms have experimented with tokenizing bonds, private equity, VC shares, and many other forms of assets.

The primary difference of these offerings from the PATI is that the underlying asset in tokenized equities is a security, and continues to remain a security throughout its lifetime. The PATI, in contrast, is used to represent a decentralized protocol token, ultimately a commodity, and to cover the entire lifecycle of one and link it to the public market through a vehicle that both issues and is able to convert the public equity to the underlying protocol token. Although it is initially offered as an investment contract, the token itself has never and will never have the intention of being a security long term.

Unlike Digital Asset Treasury (DAT)

The Digital Asset Treasury (DAT) has been popular as of late, under which a publicly traded company issues either debt or equity (or both) and uses it to buy an underlying crypto protocol token to hold on it’s balance sheet. This protocol token is not redeemable for the public company’s assets, and therefore allows the public company to trade at discount or premium to the NAV, making this a pure speculative play. The terms of each transaction in this structure will determine whether the company has a significant burden to shareholders or debt holders in a bear market. Since the shares are never redeemable for the underlying crypto, these structures are significantly different, and ultimately are simply an access play for capital markets investors and we believe are mostly treated as a “flip” or trade by buyers. Only if the DAT provides access to a new type of liquidity or function, for example tokens that are not available elsewhere in public markets, or provides staking rewards, do they provide any sort of intrinsic value.

Additionally, with crypto treasury companies, the public companies are buying already-issued protocol tokens, and back-dooring these into a public vehicle that has no redemption process. In stark contrast, the PATI is created to facilitate the full lifecyle of a token’s existence, from creation to issuance to 1:1 conversion with the public equity. Thereafter, there should be only one PATI for every protocol, where in the case of a DAT there appears to be many for a given cryptocurrency. The PATI is a more straightforward mapping and therefore in-line with our beliefs in how cryptocurrency markets should operate.

Like ETP

Post Fusion, the PATI most closely resembles an Exchange Traded Product (ETP) or Exchange Traded Note (ETN), under which a public company holds an underlying commodity and its shares track the Net Asset Value (NAV). This model relies on Authorized Participants (APs) which can create/redeem shares, i.e. send the underlying commodity to the trust and have shares created, or receive the underlying commodity from the trust and redeem shares in return. This can be done in-kind or for cash at NAV. This provides deep liquidity and connection between two large markets, the equity market and the underlying commodity market.

The major difference when comparing an ETP with PATI is the issuance of the token is built into the lifecycle of the PATI.The vehicle starts as a public listed company that acquires the protocol IP. Later, when the Token Generation Event (TGE) occurs directly from the public vehicle, the PATI will trade more like an ETP, under which market makers maintain price alignment across both markets. Authorized Participants can create/redeem the tokens for equity.

Essentially, the PATI offers ETP-like liquidity before and during the TGE, offering a structure which is strictly superior to all existing mechanisms for issuing and trading tokens.

Connecting Crypto with US Capital Markets

The PATI is a revolutionary new method to connect public and crypto markets, driving a new phase in liquidity and capital formation. By using a public company to issue the token, and then converting the public company into an ETP that can track the underlying protocol token 1:1, we have created a clear bridge between two large worlds that was not previously accomplished.

We expect this new phase in capital formation to drive many forms of business and therefore jobs to the US. The US markets are the most deep and liquid and sophisticated in the world, the envy of the rest of the world. We have won in every previous iteration of financial markets over the past decades, and crytpo should be no different. Doing primary token issuances into them directly with the PATI, and then providing a vehicle to trade and convert, will increase volumes and therefore fees collected by industry participants. Protocols that are offshore will move onshore to access US markets.

By introducing the PATI, and working with regulators and industry participants to roll it out in full compliance, the PATI will further establish the US as the premier capital markets hub in the world. Until this current administration, the US has been cut out of crypto due to regulatory hurdles, and we now have the ability to not only win back global market share, but to introduce a new vehicle that will further cement America as both the thought leaders, execution center, and liquidity hub for capital markets in the world.

Follow us at @Harbor_DEX for more market insights and commentary.